german tax calculator for foreigners

The rate of this tax is not uniform for all taxpayers but increases according to the level of income. German income tax calculator this program is a german income tax calculator for singles as well as married couples for the years.

Salary Calculator Germany Salary After Tax

The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions.

. Nonresidents have limited tax liability. The average median gross salary in Berlin is 42224 according to 2022 figures. Its rate ranges from 35 to 65 of the property value.

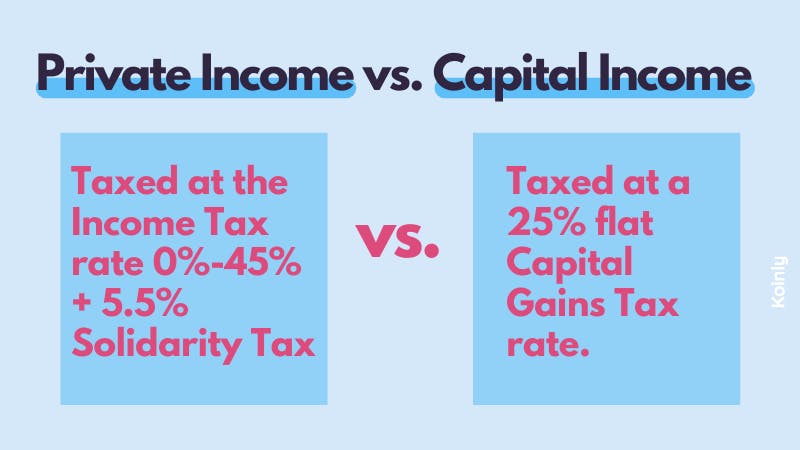

Good to know before you fill in the salary calculator Germany. The tax is only due on the capital gains above the savers lump sum of 801 euros per person. Our operators speak English Czech and Slovak.

This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. Upon closing a transaction the buyer pays a non-recurring real estate purchase tax Grunderwerbsteuer. The German tax system can be pretty complicated as the German tax system is progressive.

Usually within 24 hours. For each month your return is late youll be fined 025 of the. The income tax rate for residents whose taxable income does not exceed.

Corporate tax is paid at a flat rate of 15. For assistance in other languages contact us via e. If you wish to calculate your salary Social.

Non-residents who do not have a German office or permanent establishment pay tax only on income that is earned in Germany. The average tax burden is significantly lower. On top of these headline rates of tax depending on your income you may also pay a solidarity surcharge.

After taxes that comes out to 27878 annually or 2323 a month. Just ring us through and we will call you back as. Germanys progressive tax rate ranges from 0 for incomes below 10347 up to 45 for the highest salaries.

Gross Net Calculator 2022 of. This is quite a bit lower than the average. Tax fines in Germany.

Income from self-employment that took place abroad. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. Income tax in germany for foreigners calculator.

Gross Net Calculator 2022 of. This program is a German Wage. Just ring us through and we will call you back as soon as possible.

It starts at 1 and. 2022 2021 and earlier. Income tax in germany for foreigners calculator.

The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. This Wage Tax Calculator is best. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

274612 EUR and above. German Wage Tax Calculator. Income tax in germany for foreigners calculator.

Anyone who fails to file their German income tax return on time is subject to late filing fees. 57918 EUR - 274612 EUR.

Taxfix Your Digital Tax Accountant Taxfix

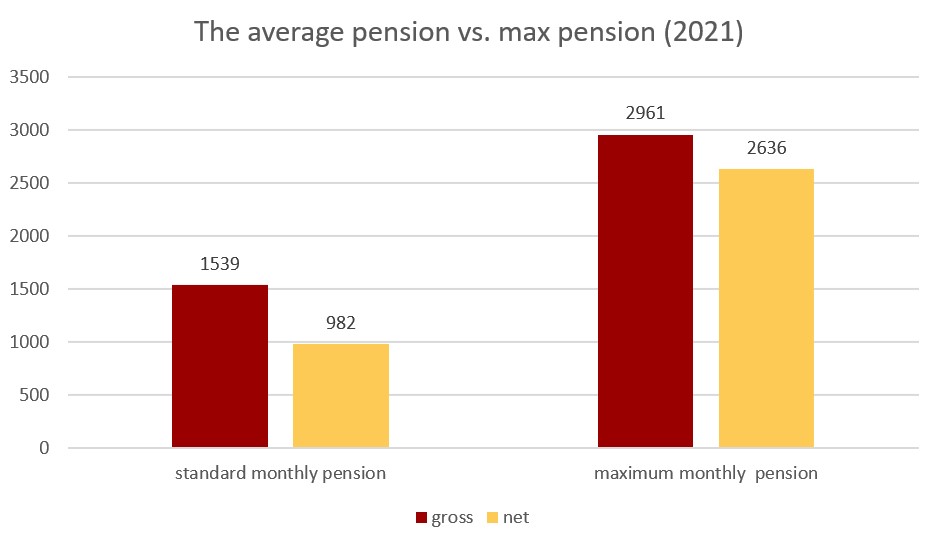

Pension System In Germany Public Private Pension Plans

Spanish Tax Calculator For Expats And Pensioners 2022 23

German Income Tax Calculator All About Berlin

Tax Calculator Designs Themes Templates And Downloadable Graphic Elements On Dribbble

Spanish Tax Calculator For Expats And Pensioners 2022 23

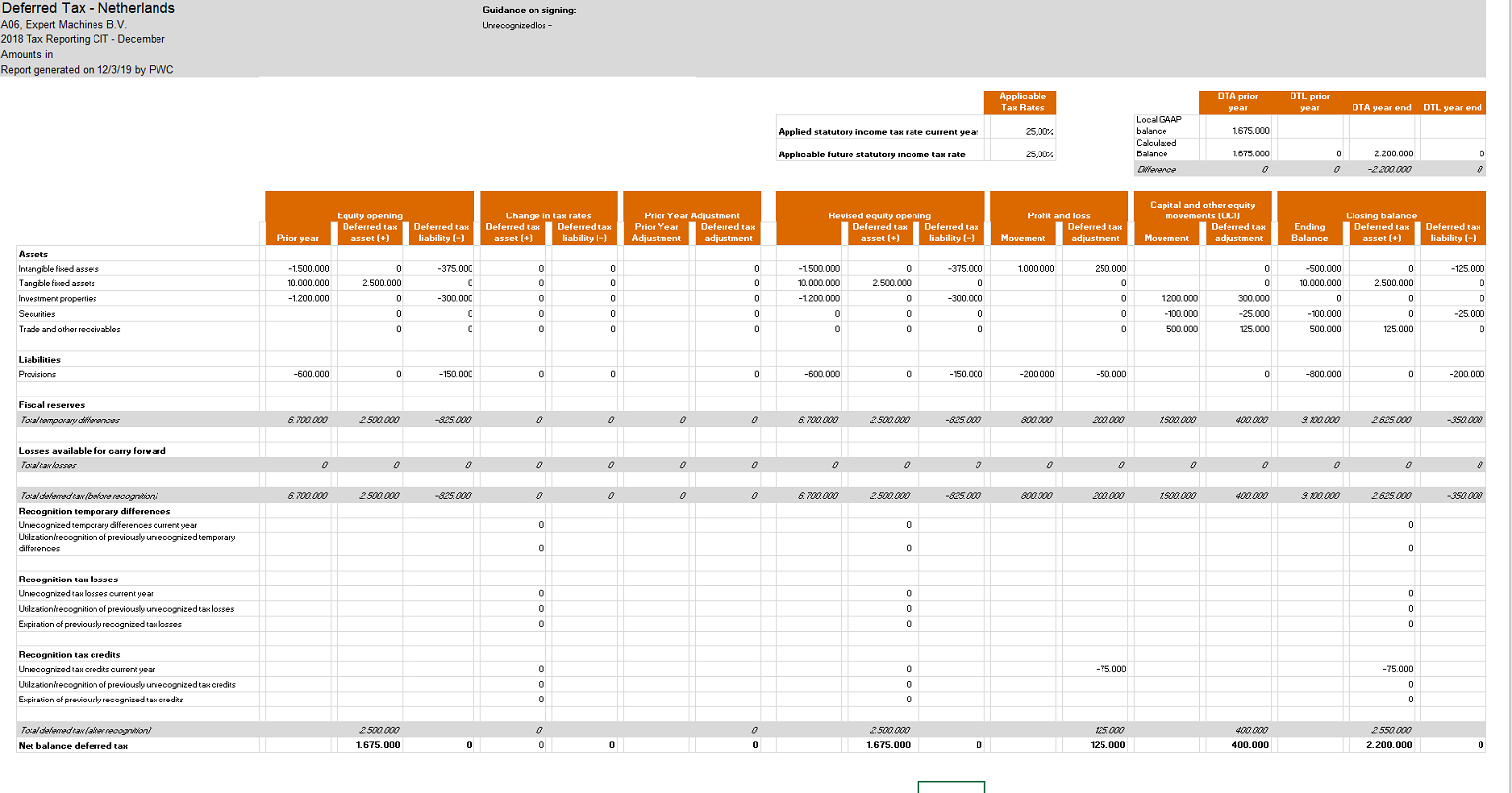

Tax Provision And Reporting Solution By Pwc Wolters Kluwer

Which Is The Best Country To Live In Germany Or Canada Quora

Social Security Taxes Expatrio Com

Forecasting German Freelance Net Income Finance Toytown Germany

German Tax Refund And Social Security Refund Services

Excel Formula Income Tax Bracket Calculation Exceljet

Salary Calculator Germany This Is How Much Net Income You Will Earn Sib

It Freelance In Germany 3 Main Tax Types 2 Einkommensteuer Income Tax Https Jaroslavplotnikov Com

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Pay Tax In Spain And What Is The Tax Free Allowance

Private Pension Insurance In Germany Overview Best Options Hypofriend

Tax On Footballers Salaries Tax Rates In Top 5 European Leagues